Banco Central do Brasil launched an instant state-backed retail payment system back in November 2020 called Pix. You might know all about it already. If not you should.

Why? Pix is a powerful case of the state innovating to benefit its population, disrupting the rents collected by financial institutions & big tech.

What problem was Pix trying to solve?

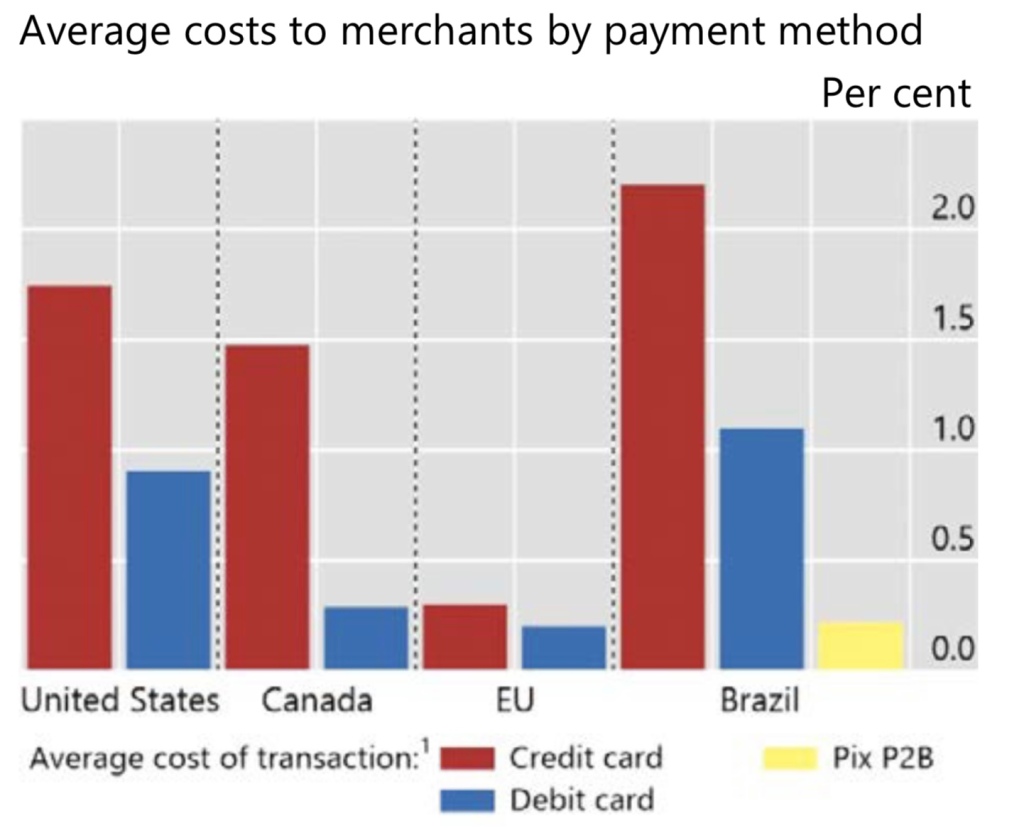

Firstly, payment systems are expensive. McKinsey reckon that in 2019 payments revenues doubled over the last decade to around $2 trillion in 2019 – 2.6% of the GDP of countries covered by their work (and rising)! Running a payment system is super-profitable. To take Visa and Mastercard as examples, profit margins are comfortably north of 40%.

But that’s how capitalism is supposed to work right? Smart people get together to form banks, or firms like Paypal, Visa, Square etc, innovate better products that make our lives easier/ nicer/ more productive and get super-profits in return. Yes!

These super-profits are supposed to be competed away as they attract new competitors. The market is supposed to solve these problems, not the state! However, there has been little sign that these super-high margins are getting squashed. Network effects attached to payment systems can represent huge competitive moats!

As a non-profit state-backed retail payment system, Pix is much much much cheaper. Take a look at the chart below from the Bank of International Settlements’ recent report:

Second, payments systems can be slow. And this can be a problem for small firms. Nowadays, when I buy a sandwich with my debit card my phone buzzes to tell me the money has left my account. But it may not reach the vendor for days. So small firms will see themselves as essentially financing banks and others in the payment system. Pix delivers final settlement in seconds.

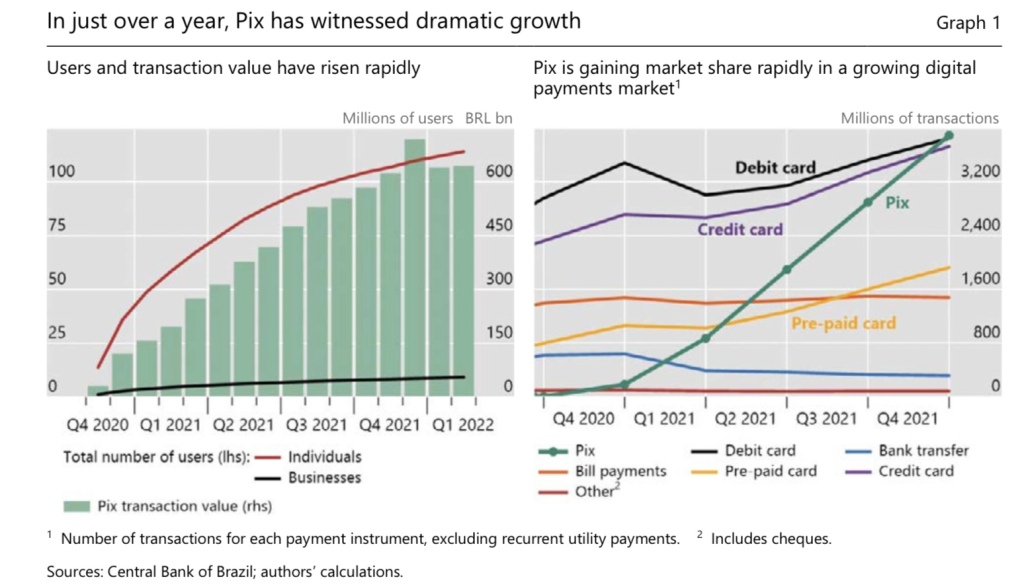

How successful has it been? Hugely. Pix has become the number one payment means by transaction volume, used by 114m people – 67% of the adult population – having been launched only in November 2020.

Okay, but why should you care?

The state is generally seen as good at funding a lot of the basic science, and even some quite advanced bits and pieces (like, er, the internet) that private sector firms then commercialise. But we tend to rely on market forces to eat away rents. Rents can prove very sticky. Pix offers an example of the state innovating, bringing to market what appears to be a superior product to its population, and in so doing leaning hard against these sticky rents.

But that’s just Brazil, right?

There’s an awful lot of work going on to bring the possibility of Central Bank Digital Currencies (CBDCs) into existence across the world. The BIS survey of central banks in 2021 found that around 85% of central banks were engaged in work on CBDCs. Pix is not a CBDC. But it does offer a glimpse into the way in which a retail CBDC might be successfully introduced, and the sort of impact low-cost digital state money could have on the payments market.

Great post but I am interested in why you draw the connection to a retail CBDC? I would have thought you might equally concede that central banks can achieve as much or more with a well designed fast payment system where the central bank works actively to sponsor its adoption?

LikeLike

Thank you!

I think you’re right that the sort of gains attached to Pix could be delivered by other central banks without going down the retail CBDC path.

But it seems to me that such gains are likely to be delivered in the course of delivering a retail CBDC, and most central banks appear to have begun their journeys towards CBDC adoption. As such it seems that Pix offers a glimpse into the future for citizens of many countries if projects in train comes to fruition.

LikeLiked by 1 person

Do I understand you correctly. You are saying that central banks seem to be committed to pursuing CBDCs so you take that as a given. The relevance of Pix is then simply that it illustrates the potential value a CBDC might deliver in the form of faster and cheaper payments?

LikeLiked by 2 people

Yes – I think this is right (or at least *a* potential value that a CBDC might deliver).

LikeLiked by 1 person

I’m fascinated by Pix, too.

Looking at Canada in that chart just makes me groan. We have an efficient & cheap debit card system, Interac, but it gets dramatically underused with most retail payments being routed via the expensive credit card networks. The problem is that even though we have cheap debit, the expensive credit cards win out by using tricks like reward points, cash back, and rules against card surcharges to attract users. If we wanted to make Canadian payments cheaper, a Pix-style rail or a CBDC wouldn’t cut it. The entire credit card model needs to be subverted.

LikeLiked by 3 people

Thanks. I claim no real authority on this question but the BIS at least seems to favour an intermediated CBDC model where the customer account and relationship is maintained at a private bank. I am wondering if that would by itself generate the benefits you see. If the central bank does not take on the role of providing the bank account then will those benefits automatically accrue. This then begs the question whether investing central bank time and resources might get a better outcome (from a cost and speed perspective) if they were devoted to taking the fast payment system route rather than developing a retail CBDC?

LikeLiked by 1 person