In a gently mocking (but good-natured) tone, Lorcan Roche Kelly asked me yesterday (rhetorically) how much moneyness I thought a tip on the horses had. Answering rhetorical questions tends to win few friends, but I think it is an interesting one.

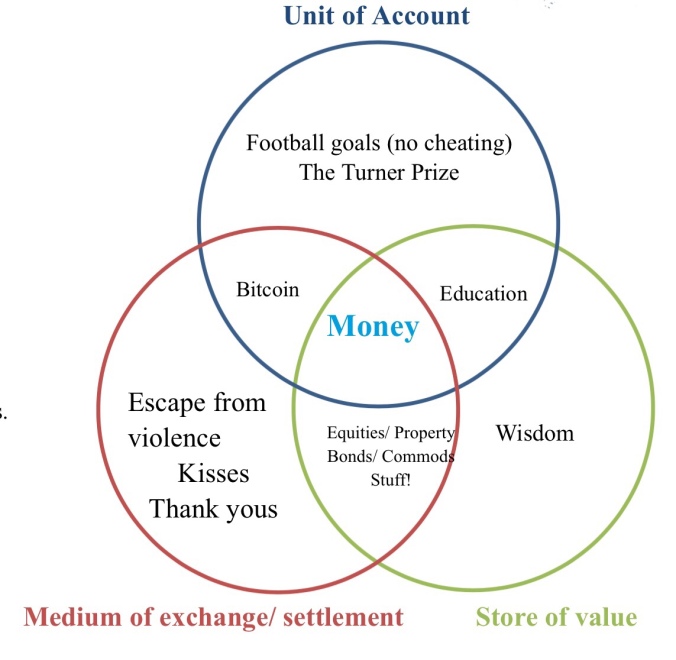

As background, money tends to be thought of as the stuff that functionally happens to satisfy three conditions: serving as store of value, unit of account, and medium of exchange. I still quite like this old Venn I made for a talk I gave on money:

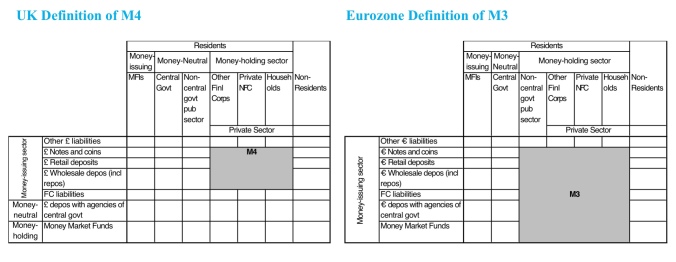

In a conventional monetary aggregate sense, definitions of money vary from jurisdiction to jurisdiction, and within jurisdiction over time. The grey shaded sections in the two tables below show how UK M4 and Eurozone M3 monetary aggregates are defined and differ at a high level.

So, for example, UK households’ deposits with agencies of the UK central government don’t count as money to a UK monetary bean-counter, while Eurozone household deposits with agencies of Eurozone central governments do count as money to Eurozone monetary bean-counters. To someone less interested in counting monetary beans this seems a bit silly, but follows from having to draw the line somewhere – and the Bank give a nice primer on this here.

If you reflect that there are many many shades of grey, the appeal of an approach that recognises the extent of this gradation is significant. Hence the attraction of moneyness.

I think that maybe all Stuff apart from notes, coins and bank reserves administered by the central bank (ie, the stuff that sits in the part of the Venn that takes medium of exchange and store of value) has some money-like quality, however tiny, and that this portion of its value is its moneyness.

I like to think that the moneyness of a thing as being some function of its duration, creditworthiness and secondary market liquidity.

So I consider a small sight deposit in a highly creditable bank to have near full moneyness. A bond due to be repaid in thirteen months by a monetary sovereign (eg, UK government) would also (in my understanding, although not in a monetarist’s sense) have very high amounts of moneyness. The amount of moneyness would be lower for debts with more distant maturities, although longer-dated securities’ moneyness can be bolstered by the degree to which they are accepted and can be borrowed against as high quality collateral. Changing collateral haircut schedules in repo flowing from a change in view from a credit rating agency or central bank can quickly change the moneyness attached to long-duration instruments; changing secondary market liquidity conditions or changing regulations regarding rehypothecation could also be a big deal for aggregate moneyness. Shadow-banking folk have been banging on about this (perhaps using different terms) for years.

So, back to Lorcan’s dig. I actually think it is a genius of a question because it takes things to an extreme (the moneyness not even of a betting slip but of a betting tip!).

The tip in question was for Circus Couture, which was offered at 12/1 on the 4:20 at Ascot. According to our tipster these odds were far too good. Maybe 4/1 was fair. Is there moneyness attached to this tip? Sounds silly, but let’s take it apart.

We can think of a betting slip as a really really short-dated super-high yield ultra-junky bond. A 12/1 outsider is like a zero coupon bond offered at 7.70 and maturing the same day at par. If the bid-offer spread that is the raisin d’etre of bookmaking did not exist, there was perfect liquidity in this choice market and the odds were stable I can see that there is a case to be made that the slips value would be close to its moneyness at somewhere close to 7.7% of par. This recognizes for the market a role in altering the moneyness of contracts as information develops, and this strikes me as a not unreasonable characterization of real life.

But no-one bets on a horse based on the view that the odds are fair. A bookie’s whole business model is to get on the inverse of punter-facing odds to extract a steadyish return for services rendered, and this is hardly a secret. And I think punters walks into a betting shop seeking excess returns (as well as leisure services), and am not sure they are even risk-neutral. So I wonder to what degree the moneyness of the betting slip (and, actually, the moneyness of any credit security) should not be discounted using a rate higher than that used to value it to account not only for the perceived risk of pay-off, but also the uncertainty of pay-off. (There is probably a big literature on how financial markets proxy uncertainty as risk so that they can get it into models, but I haven’t sought it out.)

Moving on to the tip itself, if I put a bet on Circus Couture with the view that 4/1 was the fair price, this would be akin to buying a bond at 7.70 with a view that the fair price was 20. The value of the tip to me and anyone who believes the tipster is around 12.3 cents in the dollar. But the moneyness of the tip is zero, precisely because it accounts for my differences with the market.

I think this is just be a long way of saying that a tip is not ‘Stuff’, so it has no moneyness in the framework I set out. But given that money is a medium by which subjective views as to what value constitutes is triangulated (on a monetary wealth X conviction-weighted basis) *as well as a thing*, it feels weird to say that each and every of the individual subjective views that together coagulate into a market price are themselves without measurable worth (or measurable moneyness). Or rather that the worth of each view corresponds precisely to its market impact (the degree to which it moves the market price), and any account of moneyness that includes market price will be correspondingly impacted.

This leads me to the view that a good betting tip* (that is ultimately right) has no moneyness even if a bad betting slip (attached to an ultimately losing horse) does (prior to the race!). But if there was a way to securitize betting tips…

* In the end the tip was bad – the horse came in fifth – so maybe zero worth

Pingback: Best of the Web: 18-04-26 nr 1877 | Best of the Web

Pingback: Best in Economics this week: May 18 | Best of the Web

In addition to that you need to watch for the suitable period and select the

good rely.

LikeLike